After the demonetisation chaos, the government is expected to be proactive in terms of policy actions both in and outside the Budget. The Indian economy is expected to be back on the recovery path from the second half of 2017 as the liquidity crunch wanes and the pent-up demand comes back to the fore.

Most market participants say Indian equities will perform well in 2017, and the Nifty, which gave negative returns in the past two consecutive years, has the potential to scale new lifetime highs. Here are some of the best picks for the next year from leading brokerages --Compiled by Rajesh Mascarenhas

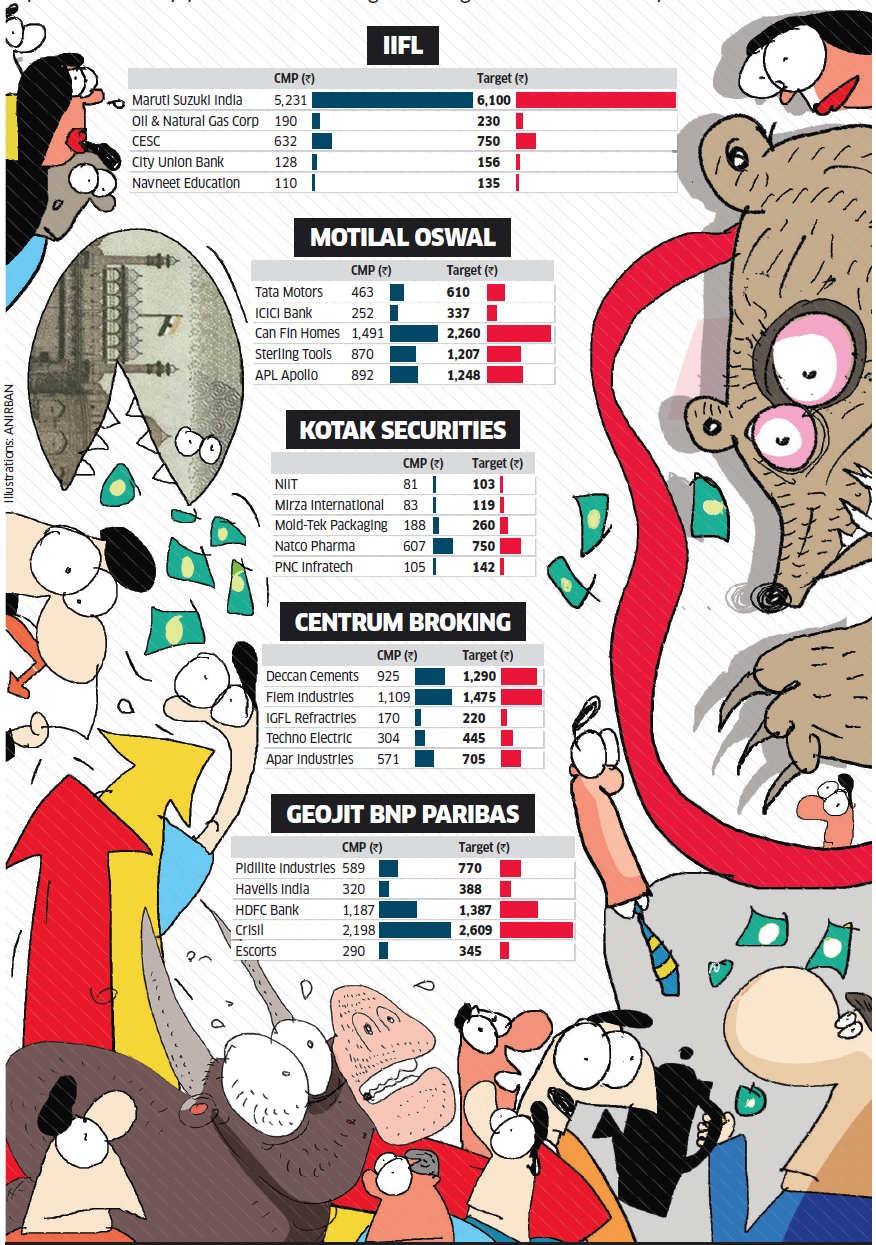

IIFL

Maruti Suzuki Target Rs 6,100

We are bullish on Maruti Suzuki on account of strong volume growth despite demonetisation. Significant waiting period, enhanced capacities along with new product launches will ensure continued volume outperformance. Low dealer inventory will lead to higher wholesales vs. retails sales. At our target price, the stock is trading at 22xFY18E.

City Union Bank Target Rs 156

We believe Citi Union Bank is an outperformer in terms of capitalisation, asset quality and returns (ROA). This is driven by its niche business model (working-capital lending), healthier margins, superior non-interest income and lower cost ratio that resulted in healthier ROA compared to its peers. We are expecting the PAT to grow at 20% CAGR over FY16-18E while ROA and ROE to be at 1.5% and 18%, respectively . The stock is currently trading at 2x PB FY18E.

Navneet Education Target Rs 135

Navneet Education is one of the most profitable education companyies in India. Supported by aboveaverage monsoon, we expect a recovery in sales from the contribution of Maharashtra business. The stationery business is expected to improve due to focus on export business. Considering the high ROE and strong growth going forward, we expect strong earnings growth in FY18. At our target price, the stock is trading at 18xFY18E.

CESC Target Rs 750

We are positive on CESC due to sector beating earnings growth of >25% CAGR till FY19E on the back of commencement of Chandarpur IPP PPA (600MW) and stable Kolkata utility business. Lower fuel costs and efficient energy sourcing from Haldia plant will improve margins. The stock is currently priced at 5.5x FY17E EV EBITDA. Any monetisation of non-core retail business will lead to further triggers for the stock. ONGC Target Rs 230 We are bullish on ONGC as rampup in production from the redevelopment projects in Mumbai High (North & South) will help in volume pick.Benign crude prices will ensure minimal or zero underrecoveries. We believe that the net realisations will rise in FY18 leading to decent outperfor mance going forward.

Centrum Broking

Deccan Cement Target Rs 1,290

DCL has 50 years of limestone reserves, 18MW of CPPs (~70-75% captive) and easy access to fly-ash and coal. Its manpower and capital costs are one of the lowest in the industry . Its well-diversified sales across entire south and Maharashtra region helped DCL generate higher EBITDAMT and a steadier EBITDA margin compared to its peers. Its return ratios are currently among the best in the industry and are sustainable on its continued strong OCFFCF. DCL has used its strong FCF to de-lever its balance sheet.

Fiem Industries Target Rs 1,475

Over the years, FIEM has reported robust top-line growth and best-inclass margins. Further, the company has not only gained traction with existing clients but has also been adding new clients and products. Extensive R&D set-up has enabled FIEM to offer superior design and development capabilities to its customers. FIEM is the first company in India to have an NABL accreditation for photometry lab to test automotive lamps.

IFGL Refractory Target Rs 220

There is a strong opportunity for IFGL to gain steady market share globally with its strong FCF generation and low leverage with consistent payouts. It has well-funded asset base providing large incremental growth opportunity at very little capex.

Techno Electric Target Rs 445

Our inference of average RoE of 35% and RoCE of 86% in the EPC business. The company's debtequity is among the lowest in the industry . Its strong niche in substation EPC works and ability to compete with large MNCs has helped the company win contracts and deliver on profitability and growth.

Apar Industries Target Rs 705

Apar, with its dominant market share and diverse product mix of conductors, transformer oil and E-beam cables, will be the key beneficiary of the uptick in the T&D capex cycle. Cost efficiency, pricing discipline, near exhaustion of low margin export orders, efficiency in working capital cycle and FCF yield of 10% at FY18E makes it attractive.

Kotak Securities

NIIT Target Rs 103

The initiatives taken by the new management have led to consistent improvement in revenue growth and earlier-than-expected benefits on margins over the past six quarters. We remain optimistic on the prospects of NIIT.NIIT has launched new programs in S&C business and added new clients in CLS, which should support future growth.

Mirza International Target Rs 119

Mirza intends to grow Redtape business by aggressive marketing and increasing focus on online business. It is also planning to foray in the affordable segment under a new brand, Bondstreet, in the domestic market. It intends to penetrate this segment by offering quality products at a competitive price to its competitors. MIL has a fully integrated model and has a track record of generating 20% plus RoCE and positive operating cash flows, based on robust margins and control over working capital.

Mold Tek Packaging Target Rs 260

Mold Tek Packaging is a leading manufacturer of high-quality rigid plastic packaging products nd a pioneer is Inject Mold Labelling (IML) for lubricants, paints and FMCG industry . Mold Tek Packaging stands to gains in the coming years from the increasing share of IML, The stock trades at 12.5x FY18E earnings, and on EVEBITDA, It trades at 7.5x FY18E.

Natco Pharma Target Rs 750

Strong R&D capabilities and focus on creating a niche product portfolio sets Natco apart from its peers. For the coming years we expect both US and domestic formula tions to further lead the growth and enable the company in posting 58% revenue CAGR and 87% PAT CAGR over FY15-18E. The stock we believe will continue to trade at higher multiples given the events lined up over the next 6-12 months.

PNC Infra Target Rs 142

PNC has track record of timely and before schedule completion of projects and received early completion bonus. It has robust current order book of Rs.62.2bn.This gives high revenue growth visibility for the next 2-3 years. It has consistently enjoyed margins of about 12-14%, which is good for road-construction company.

Motilal Oswal Securities

Tata Motors Target Rs 610

JLR volumes and revenues expected to grow at CAGR 12.5% and 15%, respectively , over FY 17-19E, driven by new product launches.This coupled with mix improvement and full benefit of forex would drive realisations and revenues. JLR's EBITDA margins expected to improve sharply from Q2FY17 levels of 10.3% to 17% by FY19 driven by realisation of forex benefit, mix improvement, benefits of modular platform and operating leverage.

ICICI Bank Target Rs 337

Strong capitalisation (CET1 of 13%), significant improvement in granularity of the book (52% retail and SME), sharp improvement in liability profile (CASA ratio of 40%) is helping ICICI Bank to build a low risk business without much impact on core earnings.On asset quality , high proportion of incremental disbursement to A and above rated corporate and recognition of actual stress on balance sheet will reduce concerns over asset quality in FY17.

Canfin Homes Target Rs 2,260

Low cost funding from NCDCPpublic deposits is expected to increase to 60% by FY18E from 35% in FY16. This is expected to translate into expansion of spreads from 2.23% in FY16 to 2.9% in FY18E. It has set a target of achieving loan book of Rs 35,000

crore by 2020 which translates to a 33% CAGR in loan book, which is much higher than the 20-22% growth expected for its peers. We estimate Canfin's loan book to compound at 28% CAGR over FY16-18E.

Sterling Tools Target Rs 1,207

The company has started work on the phaseI expansion for a new plant in Gujarat. Total capex for the project will be Rs 50 crore, likely to be commissioned by September 2017.Conducive macro factors like good monsoons, 7th pay commission roll out, passage of GST, increasing localisation by OEMs will propel the company on growth path, going forward. We expect earnings growth of 20% over FY16-18E. We value the company at 20 times FY 18E EPS with a target price Rs 1,207.

APL Apollo Tubes Target Rs 1,248

We expect the domestic ERW pipe market to grow at a CAGR of 9% over FY16-19E to 10 million tonnes by FY19E. The bulk of the growth will come from the construction and infra segments (airports, mall & prefabricated structures) using the structural pipes followed by demand from traditional applications. APL is planning to expand its capacity further to 2 mt by Q1FY18. We value the company at 15 times FY18E EPS of Rs 83.2.

Geojit BNP Paribas

Pidilite Industries Target Rs 770

Pidilite Industries is a pioneer in consumer & speciality chemicals in India having a dominant position in the adhesive and sealants business in India with market share of 70%. Robust distribution network and continuous focus on developing new and innovative products will further aid in augmenting market share and strengthen its brand equity. As a result, Pidilite is a strong play on recovery in discretionary spending and thus, we recommend buy .

Havells India Target Rs 388

Havells is a leading player in electrical consumer goods with key verticals include switchgears, cables & wires, lighting fixtures and consumer appliances. Though the current liquidity crunch is expected to impact the company's consumer durables segment in H2FY17, but given the long-term benefit of shift from unorganised to organised segment, the future prospects are positive.

HDFC Bank Target Rs 1,387

HDFC Bank has a proven track record of higher than industry growth rate with best in-class asset quality and high profit margins in the past five years. We expect HDFC Bank to continue outpacing industry credit growth rate and factor 19% CAGR in advanc es over FY16-18E. Strong contribution from retail segment (50% of domestic loan book) adds strength to the loan growth outlook.Higher share of working capital and retail financing in total loan book reduces risk of any negative surprise on asset quality front.

Crisil Target Rs 2,609

Crisil, with a market share of around 60%, enjoys leadership position in rating business. It also provides research and risk & advisory services, which has reduced cyclicality in its revenue and profitability. Crisil has consistently outperformed the industry over the last 10 years and maintained strong RoE of 30%. Revival in global economy will support growth momentum in research business and measures from RBI to deepen the corporate bond market will give boost to the rating business.

Escorts Target Rs 345

Escorts, the third largest manufacturer of agricultural tractor is well-placed to benefit from demand recovery as a result of initiatives such as farm consolidation and farm machanisation, through recent product launches and strategic decisions to improve distribution channels. We believe, temporary slowdown in the rural demand is more than factored in at the current prices.

No comments:

Post a Comment