Aug 16, 2016, 12.30 PM IST

A survey conducted by global investment bank firm HSBC showed 47 per cent of working people in India have not started saving for their future or have stopped or faced difficulties while saving.

Retirement planning is a complex process. Ideally, retirement planning should consist of a mix of different assets classes and instruments such as equities, MFs, debt plans, as well as monthly income schemes, NPS etc.

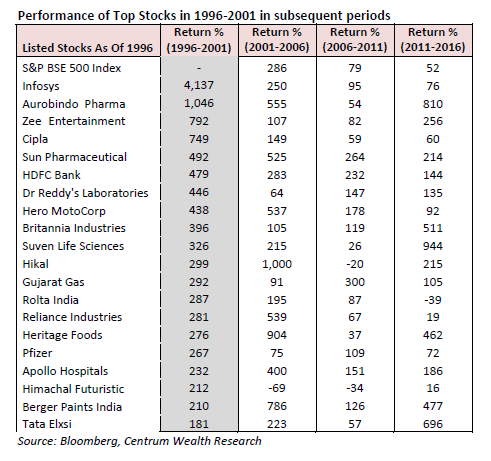

According to a report by Centrum Wealth, 20 stocks which have performed consistently from the year 1996 include Infosys, Aurobindo Pharma, ZEE Entertainment, Cipla, HDFC Bank, Dr. Reddy's Laboratories, Hero MotoCorp, Rolta India, Pfizer, RIL, Tata Elxi and Gujarat Gas, among others.

Top performers of 1996-2001 in the S&P BSE500 index were no longer

the top performers in the subsequent five years. "In general, all the

stocks gave consistent returns in the subsequent periods as well," Kunj

Bansal, CIO & ED, Centrum Wealth Management, said in a report.

Top performers of 1996-2001 in the S&P BSE500 index were no longer

the top performers in the subsequent five years. "In general, all the

stocks gave consistent returns in the subsequent periods as well," Kunj

Bansal, CIO & ED, Centrum Wealth Management, said in a report. "It is always said that equity is a long-term asset and gives better returns over long term. If one looks at the indices, this is true and equity does emerge as an asset class that has outperformed all other asset classes over a longer period, in terms of percentage return," he said.

How much equity will not be too much?

Retirement planning involves a period spanning 20-25 years and taking a call on stock might be a complicated task, experts said. However, there are various measures or filters which investors can deploy to handpick stocks or sectors which can withstand the test of time.

"Percentage allocation depends on risk and age profiles of investors. Ideally, retirement planning should begin as soon as an individual reaches 30 years," Dharmesh Kant, HEAD- Retail Research, Motilal Oswal Financial Services, told ETMarkets.com.

"Assuming the person is in the age bracket of 30 to 35 years, around 70 per cent of savings should ideally be invested in equities, 20 per cent should be invested in fixed deposits and 10 per cent in various insurance products, which can include medical insurance as well," he said.

To pick stocks for a retirement portfolio, investors should first analyse the business. Does it have the potential to survive the next 20-25 years? In other words, is the business moat likely to be challenged by any disruptive breakthrough?

"Disruption can be in the form enabling the business further. For example; food, garments, housing, automobile, pharmaceuticals are businesses that will stay for the foreseeable future," said Kant.

Another important thing to analyse is the inflation factor. Since it is difficult to form a definite view on the nominal inflation, it is better to delink your portfolio as much as possible from the inflationary pressures, suggest experts.

"Purely from a portfolio construction perspective, there are a few ground rules. Considering the global interest rate environment, it is good to lock in your money in long-term instruments that offer a reasonably good interest rate," Pankaj Sharma, Head of Equities, Equirus Securities, told ETMarkets.com.

"The other rule is diversification. It is the key but use fixed return instruments a little more as you need regular income, and do not forget to hedge your portfolio with non-financial assets like precious metals and real estate," he said.

There is no golden rule for selecting stocks as it depends on many factors, including how much initial corpus you are starting with.

"We would look at, long term potential and the history of the stock, dividend yield, management quality among other parameters," said Sharma. Based on the above parameters, he recommends Britannia, GAIL, Coal India, Sun Pharma and Torrent Pharma.

Sectors which look attractive for next 20 years:

Dharmesh Kant, Head of Retail Research, Motilal Oswal Financial Services, recommend five sectors that investors can consider for retirement planning:

Banking & finance: Finance is the backbone of any economy and has been there since the inception of civilization. For any economic activity institution like banks and NBFCs will be needed for project funding, or meeting the working capital requirement.

Automobiles: Transportation is an integral part of any economy. Companies which keep pace with technological breakthrough and advancement for better transportation products offer merit in selection.

Pharmaceuticals: Medicines are required at every stage of human life. Right from the time a child is conceived till the time last breath is inhaled. It can be for curing a disease or just for maintaining a healthy life style.

Companies with proven track records and focus on new product development through intensive research merits selection for long term investing.

Consumption: This area is vast. It can be biscuits, confectionery, soaps, electrical and electronic equipment like television, air conditioners, refrigerators, fans, bulbs etc., garments, home furnishing among others.

Management's vision and company's adaptability to timely come out with new products as per changing consumer preferences are key criteria for selection in the portfolio.

Materials: For any construction be it roads, ports, airports, shopping complexes, dwelling units, commercial complexes, hospitals, schools, civic amenities etc., construction material is required like steel, cement, copper. Investors can look at companies with sustainable business model which merit selection in the long term portfolio.

No comments:

Post a Comment